No Fees for Life IRA

At Patriot Gold Group, we have more than 50 years of experience being an industry leader in the field of precious metal investments. If you're looking for ways to invest your precious metals, consider opening a precious metals IRA. Our experts can help you find investment opportunities including a no fees for life IRA account.

Benefits of a No Fees IRA Account

Opening a precious metals IRA account is a great way to diversify your investment portfolio. With this kind of diversification, your wealth will be better protected against future market crashes. Gold and silver also offer protection against the dollar and its decreasing value while also hedging against inflation. Gold, silver, and other precious metals have been proven to increase their value as time increases.

Another benefit of precious metals investments is their continued ability to outperform traditional stocks. If you're looking to open a reliable, no fees for life IRA account, invest in precious metals today. This option will balance your portfolio and safeguard you against future threats.

To get started on opening your no fees IRA account, call the Patriot Gold Group at (877) 711-6641 or fill out the form at the bottom of this page. We look forward to helping you with your future investments.

OPEN A PRECIOUS METALS IRA IN

3 EASY STEPS

OUR NO FEE FOR LIFE IRA PROGRAM STARTS HERE. (Minimum Account Required)

Contact Our Experts

Fill out the form to get your free Gold IRA Investor Guide and speak with one of our representatives.

Transfer or Roll Over

Our 401(k) and IRA Rollover department will guide you step by step through the tax-free transfer process.

Own Precious Metals

Once your Self Directed IRA account is funded, we will help you buy and store your precious metals.

AND ENJOY ALL THE BENEFITS OF OWNING GOLD

|

|

|

|

PRECIOUS METALS IRA

Americans are facing a weakening dollar, nuclear threats from North Korea, and natural disasters at a time when lightning fast communications turn geopolitical murmurs into financial shocks. Physical gold and silver offer investors the protection of a balanced investment portfolio. Hold your metals in a self-directed Precious Metals IRA. Profits are tax-deferred when the proceeds from the sale remain with your custodian for reinvestment or are transferred to another IRA.

|

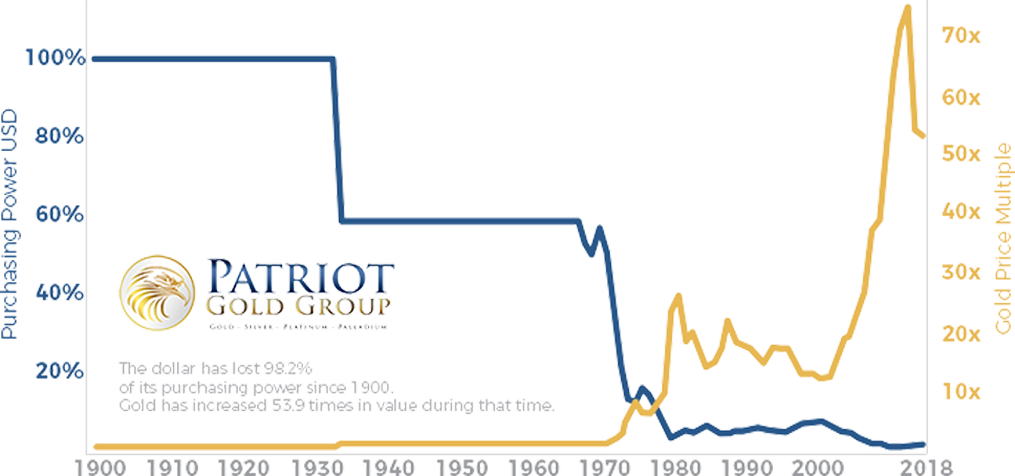

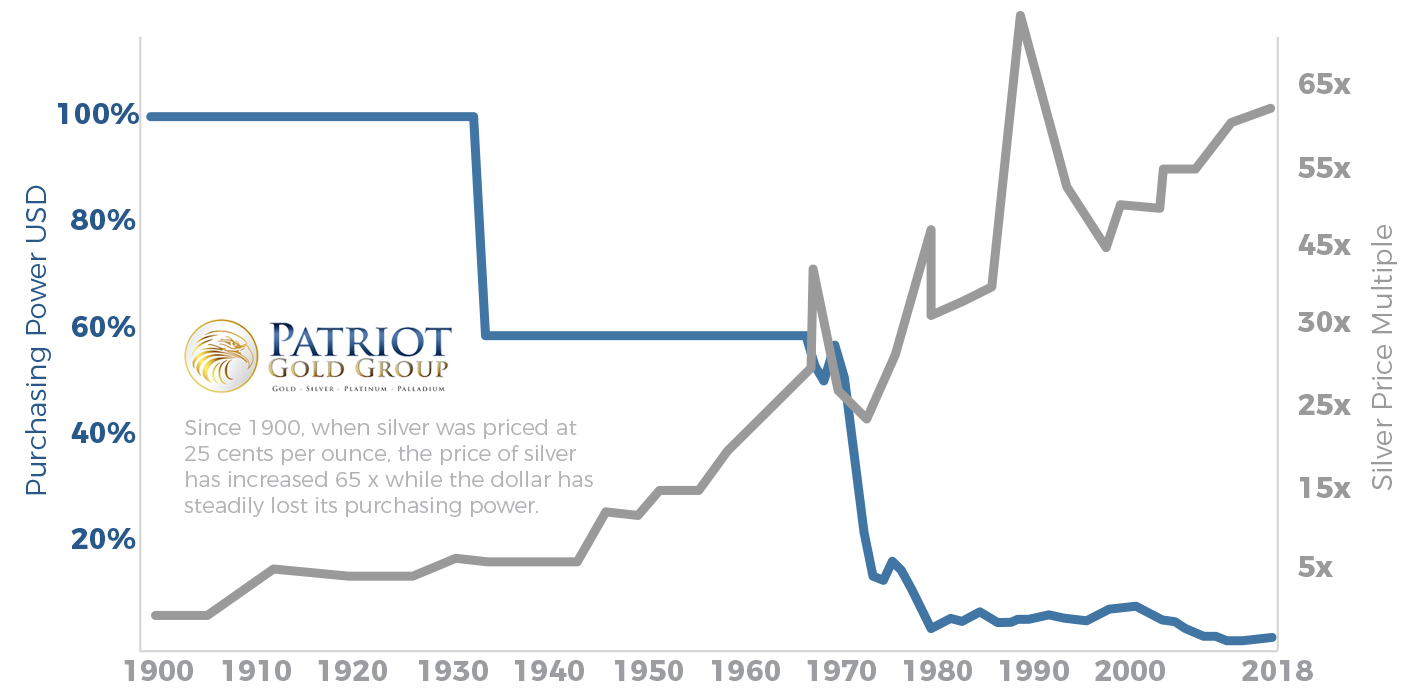

HEDGE YOUR PURCHASING POWERThe dollar has lost 98.2% of its purchasing power since 1900 while gold has increased 53.9 times in value during that same time period. In 2017, the dollar performed dismally against the 19 most-traded currencies in the world including a 12% decline against the Euro. Gold has dramatically offset the loss in purchasing power of the U.S dollar.

|

Get The Leading Gold

IRA Investor Guide

GET THE LEADING GOLD IRA INVESTORGUIDE FROM CONSUMER AFFAIRS TOPRATED GOLD IRA DEALER IN 2016 AND 2017

- What is a physical gold IRA?

- Does a physical gold IRA make sense for you?

- How do you buy a physical gold IRA?

- How do you store your physical gold?

- What are the benefits of gold IRA investment?

- What are the types of gold IRA investment?

- What causes gold prices to rise?

|

HEDGE YOUR PURCHASING POWERThe dollar has lost 98.2% of its purchasing power since 1900 while silver has increased 64.44 times in value during that same time period. In 2017, the dollar performed dismally against the 19 most-traded currencies including a 12% decline against the Euro. Smart investors have used silver to offset the loss in purchasing power of the U.S dollar. |

GET THE LEADING SILVER

IRA INVESTOR GUIDE

GET THE LEADING SILVER IRA INVESTORGUIDE FROM CONSUMER AFFAIRS TOPRATED SILVER IRA DEALER IN 2016 AND 2017

- What is a physical silver IRA?

- Does a physical silver IRA make sense for you?

- How do you buy a physical silver IRA?

- How do you store your physical silver?

- What are the benefits of silver IRA investment?

- What are the types of silver IRA investment?

- What causes silver prices to rise?

ENJOY ALL THE BENEFITS OF

OWNING GOLD AND SILVER

Control

Hold physical gold tax deferred in a Private Storage IRA or in your own hands.

Freedom

Grow your wealth in a few hours a month with your gold and silver IRA investment.

Growth

Since 1900, gold has increased in value 53.9 times while the dollar has lost 98.2%.

Security

Gold insures you against weak-performing assets and builds a balanced portfolio.

|

|

|